A global rush to safe-haven moves gold higher

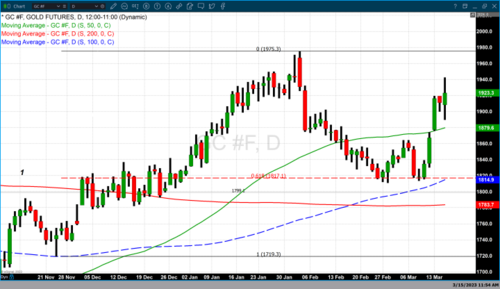

Gold prices surged today with gold futures trading to a high of $1942.50. Multiple assets traded sharply higher including gold, the dollar, and U.S. Treasuries. These gains were directly attributed to another crisis in the banking sector. This caused market participants to lighten their riskier assets and move that capital into safe-haven assets.

.png)

Today’s global rush into safe-haven assets began in Europe and then moved across the pond into Wall Street as news surfaced of a new bank failure this time in Europe. Shares of Credit Suisse initially dropped 31% and when the dust settled its stock shares had declined by 13.91%. This is because of a report of a potential plan to stabilize the bank from Swiss banking regulators.

According to Bloomberg News, “Swiss authorities and Credit Suisse Group AG are discussing ways to stabilize the bank, according to people familiar with the matter, after comments by its biggest shareholder and broader financial market jitters helped trigger a plunge in the stock on Wednesday.”

The article in Bloomberg stated that the first move to shore up confidence in the Credit Suisse bank is being led by Switzerland's central bank and its financial regulator announced that Credit Suisse will receive a “liquidity backstop if needed”.

Issues with Switzerland's second-largest lender, Credit Suisse have been ripe with problems over the last several years due to a “series of blowups, scandal sips, leadership changes, and legal issues.” Last year Credit Suisse lost $7.9 billion which eroded the profits from the previous year. Over the last three months credit Suisse depositors have withdrawn over $100 billion in assets as concerns over the multiple issues cited above.

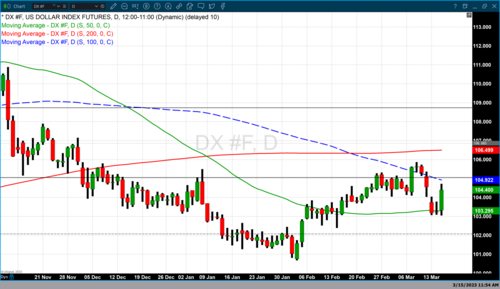

Gold futures were extremely volatile today with tremendously large price swings from the high of $1942.50 to its intraday low of $1889.50 before settling higher. As of 5:30 PM EST gold futures basis the most active April contract is currently up $12.40 or 0.85% and fixed at $1923.30. The dollar gained 1.15% and the dollar index is currently fixed at 104.40.

This has led some former Federal Reserve officials to suggest that the two most important central banks put a pause on further rate hikes until concerns over banking issues are resolved. This dramatically changed the CME’s FedWatch probability that the Fed will not raise rates at this month’s FOMC meeting to 50.5%. The probability of no rate hike in March was 30.6% yesterday, and zero before that. This probability indicator also anticipates that there is a 49.5% probability that the Federal Reserve will go ahead with another ¼% rate hike this month.

Gary S. Wagner

David