Concerns about the Ukraine war and global inflation increase bullish sentiment for gold

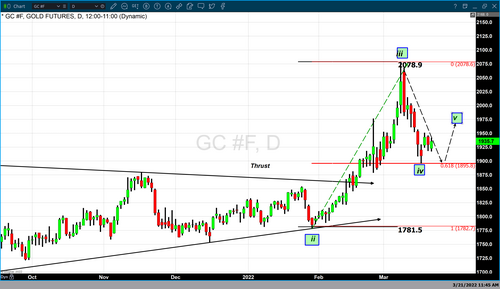

After declining over $60 per ounce last week gold found solid footing and support at approximately $1920. As of 4:30 PM EDT gold futures basis, the April 2022 contract is up by $6.50 and fixed at $1935.90. April gold has become spot pricing with a first-day delivery notice on Friday of this week. The most active contract month in gold switches every two-month increments, so the next front month for gold will be the June 2022 contract. Currently, the spread between April and June gold futures is approximately five dollars, with the June futures contract currently trading up $6.90 and fixed at $1940.80.

.png)

Both U.S. equities and the precious metals saw volatility in the market as it first reacted to statements by the Federal Reserve Chairman Jerome Powell at the National Association for Business Economics today. In his speech today, Chairman Powell said, “We will take the necessary steps to ensure a return to price stability. In particular, if we conclude that it is appropriate to move more aggressively by raising the federal funds rate by more than 25 basis points at a meeting or meetings, we will do so.”

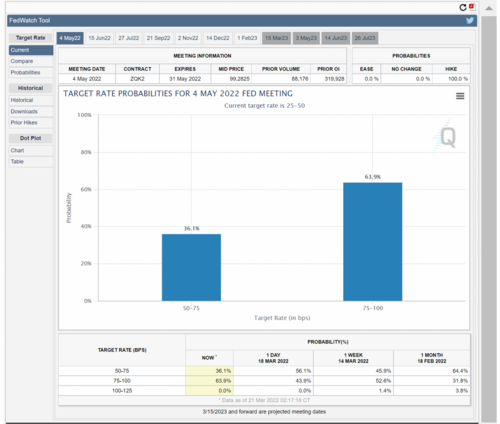

This statement, of course, reinforces the idea that the Federal Reserve is committed to reducing the current level of inflation through the use of interest rate hikes. It underscores the real possibility that the next rate hike announced and implemented will occur during the May FOMC meeting and most likely will be a rate hike of ½% rather than the anticipated hike of ¼%. This is also reflected in the Fed watch tool.

The CME’s FedWatch tool reflected the extremely hawkish statement made by Chairman Powell today. This tool currently indicates the probability of a ½% rate hike which would put the Fed Funds rate to 75 – 100 basis points (3/4% to 1%) is now 57.2% up from 43.9% on Friday. This probability calculator also indicated that the probability of a ¼% rate hike has declined from 56.1% to 42.8%.

The challenge that the Federal Reserve faces is to combat the high level of inflation effectively. To successfully combat inflation, they would need to raise interest rates to approximately the current level of inflation, with the CPI index at 7.9% in February and the PCE at 6.1% in January. That would be an impossible task to accomplish. The PCE index will be updated on March 31 and reflect February’s inflationary level. Concurrently the Federal Reserve expects to raise interest rates to 1.9% this year and 2.8% in 2023. With interest rates at that level, it would slow the economy down but have a very small impact on the high level of inflation that exists.

Inflationary pressures will most certainly increase in the United States. However, inflationary pressures in the United States will be dwarfed when compared to the inflation rate of Europe. This is because Ukraine and Russia export the largest percentage of wheat in the EU. The EU also imports the vast majority of the oil and gas from Russia.

In other words, inflationary pressures will continue to rise both in the United States and Europe, and central banks raising interest rates will not be enough to lower that pressure dramatically.

By Gary Wagner

Contributing to kitco.com

Time to buy Gold and Silver on the dips

David