Potential de-escalation with Russia – Ukraine takes gold to lower pricing

Precious metals across the board sustained moderate to strong price declines in light of recent news suggesting that the geopolitical tension between Russia and Ukraine has begun to de-escalate. Recent news indicated that some Russian troops that were positioned near the border of Ukraine began to leave and return to their base.

As of 5:10 PM EST, the deepest percentage price decline today occurred in the precious metal palladium, which sustained a loss of 4.18%, or $98 taking the most active March contract to $2248. Today’s strong decline in palladium is directly related to the potential de-escalation of the geopolitical conflict in Russia and Ukraine. Since 40% of the annual global production of palladium occurs in Russia, any de-escalation of the geopolitical tensions would have a direct bearish impact on palladium.

All of the precious metals traded lower even with moderate tailwinds from dollar weakness today. The dollar lost almost 4/10% (-0.39%), taking the dollar index to 95.985. March silver gave up almost 2% (-1.8%) and is currently fixed at $23.375. Gold futures had a significant price drop of $14.30 (-0.76%), taking the most active April futures contract to $1855.10.

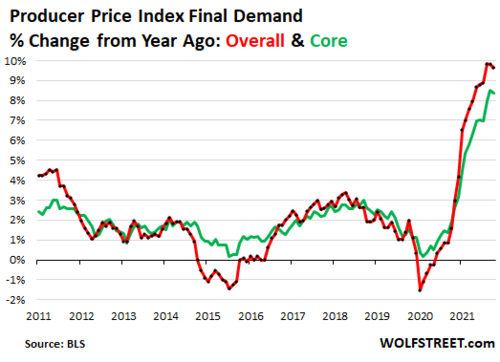

It is my current belief that the largest factor resulting in bullish sentiment for gold pricing is the current level of inflationary pressures. The recent CPI (Consumer Price Index) came in at its highest level since February 1982 at 7.5%. However, the most alarming news indicating that inflationary pressures in the United States are far away from peeking and most likely spiraling higher was today’s PPI (Producer Price Index). The producer price index is an excellent barometer on wholesale costs to companies and corporations that produce goods and services. More so, they give advanced information on the CPI and PCE index. Wholesale costs rising will be passed onto consumers at a later date.

Today the U.S. Bureau of Labor Statistics released the PPI index indicating that wholesale prices have increased by 1% in January. That takes the year-over-year wholesale price inflation index to 9.7%, which is almost a record high since the PPI was first calculated in November 2010. Before today’s report, the highest level on record indicated a year-over-year rise to 9.6% in November 2021.

Inflation will continue to climb and not taper off as the Federal Reserve has predicted for quite some time. The rise in inflation was a multiyear event that was the net result of exceedingly aggressive rises in the money supply due to administrative programs and the aggressive monetary policy by the Federal Reserve in regards to their asset sheet balance which now exceeds $8.7 trillion.

To effectively reduce inflation, two things need to happen. First, there needs to be a tapering of the asset balance sheet and a reduction of the money supply in the United States coupled with raises in interest rates. Secondly, and most importantly, effectively reduce the bottlenecks caused by supply chain shortages. As long as inflationary pressures continue to grow, there is a high probability that gold will continue to gain value.

By Gary Wagner

Contributing to kitco.com

Time to buy Gold and Silver on the dips

David