Gold unfurls all of its sails to capture strong tailwinds from dollar weakness

Extreme dollar weakness resulted in strong tailwinds which propelled gold to higher pricing today. As of 5:45 PM EST gold futures basis, the most active February 2022 contract is currently trading up by seven dollars, a gain of 0.38% and fixed at $1825.30. Yesterday’s double-digit gain in gold pricing which opened at $1801.40, traded to a high of $1822.90, and then settled just below yesterday’s high at approximately $1818 was in anticipation that today’s CPI index would reveal that inflation continues to expand. The dollar lost just over 0.7%, giving up 0.67 points, and is currently fixed at 94.955.

The U.S. dollar sold off strongly today as the Bureau of Labor Statistics released the most current data on inflation which showed that inflationary pressures continue to grow, now at the highest level we have seen in 40 years. Today’s inflation report revealed that the current level of inflationary pressures is now at a 40 year high, with the last occurrence of inflation at these levels occurring in June 1982.

The U.S. Bureau of Labor Statistics reported the following, “The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.5 percent in December on a seasonally adjusted basis after rising 0.8 percent in November, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all-items index increased 7.0 percent before seasonal adjustment.”

The largest contributors to inflationary pressures continues to be the cost of shelter as well as used cars and trucks. The report also indicated that the food index, although it increased less than in recent months still rose 0.5% in December.

The core CPI index which strips out food and energy costs is still the preferred inflationary barometer used by the Federal Reserve. The report indicated that all items with the omission of food and energy indexes rose 5.5%, “the largest 12-month change since the period ending in February 1991.” The energy index rose 29.3% over the last year with food costs increasing by 6.3% during the same period.

With inflation at these historical levels, it will not be an easy or short-term project for the Federal Reserve to halt its dramatic increase. Actions by the Federal Reserve can only do so much to alleviate the spiraling level of inflation. One of the primary causes of the recent inflationary pressures is supply chain bottlenecks and shortages. These bottlenecks are largely a byproduct of the shortage of workers. This worker shortage can be seen in factories producing the goods. It is also prevalent in those workers that are responsible for different components of the distribution. As long as there is a shortage of workers to produce the goods, unload the boats, and truckers to move the goods there will continue to be supply chain bottlenecks and shortages.

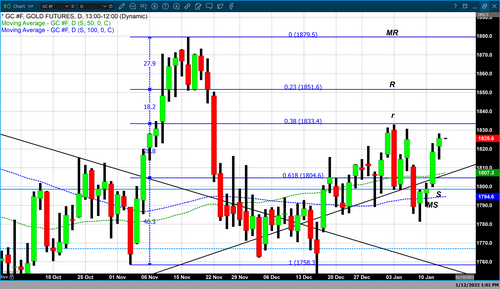

If gold continues to gain value as I believe it will, it will not encounter any of the technical resistance occurring at $1833.40, which corresponds to a 38% Fibonacci retracement. Above that resistance can be found at $1851.60 the 23% Fibonacci retracement. Major resistance occurs at $1879.50 which is based upon the high achieved on November 16 of last year.

By Gary Wagner

Contributing to kitco.com

Time to buy Gold and Silver on the dips

David