Retail investors look to gold and silver for best results in 2022, Wall Street points to silver and platinum

After a disappointing year for gold and silver, Main Street is looking for the bearish tide to turn in 2022, picking the two metals as the top performers in the new year, according to Kitco's online survey.

Gold ended the year down 3.6%, posting its biggest annual decline since 2015. Silver wrapped up 2021 with a drop of 11.5%, which was the metal's sharpest decline since 2014.

Both metals failed to gain traction throughout last year despite the hot inflation narrative, as strong economic recovery and a more aggressive Federal Reserve outlook weighed on prices.

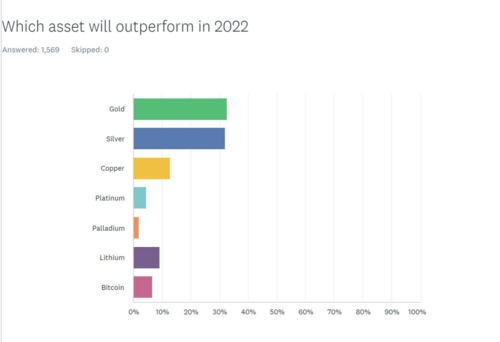

Retail investors are hopeful that the bearish trend has peaked, with Kitco's survey results showing participants almost equally split between gold and silver as the top two choices for best performers in 2022.

Out of 1,569 respondents, 32.7% picked gold as the top performer for 2022, while another 32.1% opted for silver. The third most loved metal for next year was copper, with 12.9% of respondents betting on the red metal. Another 9.2% chose lithium and 6.7% picked Bitcoin. Platinum only garnered 4.5% support, followed by palladium at 2%.

The Wall Street side is also bullish on gold and silver in the long term. Analysts told Kitco that gold is well-positioned to rally along with interest rate hikes, while silver has a chance to play catch-up after lagging behind gold for months.

"After facing numerous headwinds in 2021, we believe gold's path higher looks clearer in 2022. Moderating equity market returns and inflation concerns may bring the market's focus and flows back to the yellow metal next year. [The] greenback will not be a substantial headwind in 2022 as it was in 2021," said Wells Fargo in its outlook. "While we are optimistic that gold could finally move higher in 2022, a stronger price trend may take some time to develop, which prompts us to lower our year-end 2022 target range to $2,000-$2,100."

BofA also pointed to gold's upside in 2022 while also highlighting positive outlooks for silver and platinum. "As gold markets refocus from tighter monetary policy toward how high rates can rise, the yellow metal should rally; we believe 10Y Treasuries above 2.5% are difficult to sustain. Increased investment into solar panels should boost silver. Platinum is the rebound trade on normalization of chip shortages in the auto industry; substitution from palladium should also help," the bank said.

Bloomberg Intelligence sees gold outperforming other metals in 2022, citing enduring trends favoring the precious metal.

"A primary question for 2022 might be what stops gold from regaining the upper hand vs. most commodities, and our bias is for enduring trends (notably since the financial crisis) to prevail, which favors precious metals more than industrial and the metals sector over broad commodities," said Bloomberg Intelligence senior commodity strategist Mike McGlone. "Since the end of 2007, gold's roughly 115% gain has underpinnings from an unlimited supply of fiat currency. Greater supply elasticity is a copper headwind. Indicating the difference for investors, the Bloomberg Copper Subindex Total Return is about 20% vs. 40% for the spot."

After largely ignoring the problematic inflation narrative for most of 2021, the markets are becoming fearful of the growing price pressures, Gareth Soloway, chief market strategist of InTheMoneyStocks.com, told Kitco News.

"What I am bullish on is gold. It is going to be the biggest performer here in 2022. You should see a move up to the highs from 2020. There is even a potential for a $3,000 price target on gold. You have to look at the inflation numbers. I don't think inflation will go back to 2%. The Fed will taper, but ultimately people will rotate into gold," Soloway said.

And if gold does well in the new year, silver has a chance to outperform the yellow metal, analysts pointed out.

"There's certainly that catch-up story built in there. It has underperformed gold to date. And you'll find some switching by investors into the silver market as a consequence of that," said ANZ senior commodity strategist Daniel Hynes.

The gold-silver ratio also points to silver's outperformance, noted Perth Mint manager of listed products and investment research Jordan Eliseo.

"The very fact that the gold-silver ratio is at roughly 80:1, that alone suggests that if gold is going to rise, silver at the very least is going to come along for the ride and could quite likely outperform gold," Eliseo said. "Silver also benefits if commodities as a whole do well. If economies perform relatively strongly, it should benefit from an industrial perspective and the whole ESG transition that's taking place in the economy."

Silver price 2022: Here's how silver can outperform gold as it plays catch-up next year

Silver has the best chance to rise in 2022, said Gainesville Coins precious metals expert Everett Millman. "It is so cheap relative to other metals and other commodities. And it figures prominently in emerging technologies and green energy. It is a perfect storm for silver to finally break out in 2022, especially after it really lagged gold these past few years," Millman said.

Analysts also highlighted platinum's upside potential in 2022 due to its supply-demand fundamentals.

"Platinum doesn't have all the conspiracy and short sellers that silver has. The market is smaller. There is not a lot of players involved. You have the supply issues, but these are being resolved. You'll see platinum demand snap back. When supply chain issues are resolved, you should see platinum be the one that outperforms the rest. It's one of the underdogs from last year," Blue Line Futures chief market strategist Phillip Streible told Kitco News.

By Anna Golubova

For Kitco News

Time to buy Gold and Silver on the dips

David