Gold recovers as worldwide equites selloff

Gold truly acted as a safe haven asset today. Equities worldwide incurred a tremendously deep selloff as concerns about the Chinese property group Evergrande’s solvency. The worldwide equity selloff began overseas and then continued into the U.S. equities markets. At its low today the Dow Jones industrial average was down 900 points before recovering. The Dow gave up 614 points in trading today and closed at 33,970.47, resulting in a net decline of 1.78%. The NASDAQ composite lost 2.19% and is currently fixed at 14,713.9030. The S&P 500 lost 1.70% and is currently fixed at 4357.73.

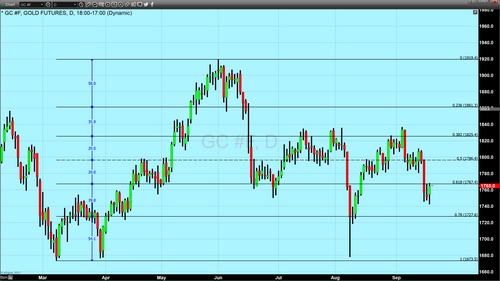

As of 5:56 PM EDT gold futures basis, the most active December 2021 contract is currently up to $13.30 and fixed at $1764.70. Silver did sustain a mild selloff closing lower by 0.41%, and after factoring in today’s decline of a little over nine cents, it is currently fixed at $22.245.

Reuters reported that “Wall Street plunged on Monday as fear of contagion from a potential collapse of China’s Evergrande prompted a broad selloff and sent investors fleeing equities for safety.”

They also added that “the equity selloff in the United States was a result of concerns of solvency of the Chinese property group Evergrande. “Gold rose on Monday as fears about the solvency of Chinese property group Evergrande sparked a flight to safe-haven assets, but gains were capped by strength in the dollar ahead of the U.S. Federal Reserve’s policy meeting. Spot gold rose 0.5% to $1,762.66 per ounce by 1753 GMT. U.S. gold futures settled 0.8% higher at $1,765.40.”

The Chinese property to developers has accumulated over $300 billion in debt mostly with the Central Bank of China.

The Federal Reserve will meet tomorrow and begin September’s FOMC meeting, which will conclude on Wednesday. Market participants and traders hope to gain more clarity as to the timeline in which the Federal Reserve will begin to taper their monthly asset purchases of $120 billion (80 billion in U.S. debt and 40 billion in mortgage-backed securities).

There is genuine uncertainty as to what actions the Federal Reserve will take in regards to their current monthly asset purchases. Their asset balance sheet has swelled to above $8 trillion in assets. However, their primary focus has been upon maximum employment, a major component of their dual mandate which is maximum employment and annual inflationary levels of around 2%. They have let inflation run much hotter in lieu of achieving their maximum employment goal. Believing that the majority of the current level of inflation is transitory, the Federal Reserve has let inflation run to 5.3%, based upon the latest CPI numbers released last week.

However, the most recent jobs report was extremely disappointing and deeply below expectations and forecasts from economists polled by the Wall Street Journal. The expectation was that the August jobs report would indicate an additional 700,000+ new jobs added to payrolls, and the actual number was a tepid 235,000 new jobs added last month.

The weak August jobs report will be weighed against the most recent report by the U.S. Census Bureau, which indicated robust consumer spending last month, resulting in $618 billion, up 0.8%. Economists polled were looking for August consumer spending to be down between -0.8 to -1.8. If you strip out consumer spending on automobiles and trucks, the actual gain for the month of August is 1.8%.

These two reports show an interesting mix between new jobs added and consumer spending. While the jobs report was disappointing and weak at best, consumer spending rose far past the expectations given by economists. Therefore, the Federal Reserve will be faced with making a decision based on strong consumer spending and weak growth in jobs. That will certainly influence their decision as to when they will begin to taper.

By Gary Wagner

Contributing to kitco.com

Buy and Sell Gold and Silver with Free Storage

David