The gold price is not going anywhere anytime soon

Stuck in a narrowing trend, gold prices are not expected to go anywhere soon as sentiment has turned decidedly neutral among Wall Street analysts with lackluster interest from retail investors, according to the latest results of the Kitco News Gold Survey.

Since mid-July, gold prices have tested resistance at $1,830 but have failed to hold the ground. The latest failed push higher and the drop below $1,800 ahead of the weekend have disappointed bullish investors and analysts.

"Gold just seems stuck in a $1,760-$1,840 trading range at the moment without much direction, and there isn't much in the way of news in the coming week that could potentially change that," said Colin Cieszynski, chief market strategist at SIA Wealth Management.

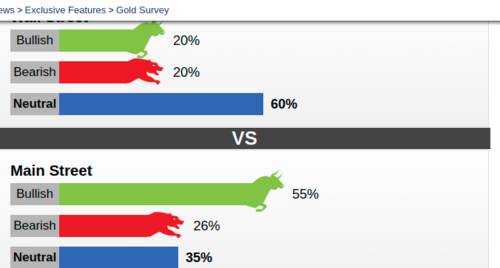

This week 15 Wall Street analysts participated in Kitco News' gold survey. Among the participants, 9, or 60%, called for gold prices to trade sideways. Meanwhile, bullish and bearish outlooks garnered three votes each or 20%.

Although retail investors are still bullish on gold, there is a distinct lack of interest in the marketplace. Participation in this week's survey fell to its lowest point since May 2019.

A total of 494 votes were cast in online polls. Of these, 274 respondents, or 55%, looked for gold to rise next week. Another 127, or 26%, said lower, while 93 voters, or 35%, were neutral.

.png)

Ole Hansen, head of commodity strategy at Saxo Bank, said that gold would continue to struggle as the U.S. dollar remains relatively strong. He added that the U.S. dollar remains the most substantial headwind against gold, with real bond yields still in deeply negative territory.

Although Hansen doesn't see gold prices going higher anytime soon, he added that in the current environment, he doesn't see gold prices falling much below $1,800 an ounce.

"The gold market has seen strong physical demand, but if prices are going to go higher, then we need to see paper investors and speculators come back to the market and they won't until they see price back above $1,830 an ounce with some momentum behind the move," he said.

David Madden, market analyst at Equiti Capital, said that he also expects gold to remain range-bound. He added that growing market uncertainty with equity markets at record valuations will keep a safe-haven bid in gold.

Marc Chandler, managing director at Bannockburn Global Forex, said that he is also bearish on gold as he sees more momentum for the U.S. dollar in the near term. He added that rising inflation is pushing interest rates higher and that is supporting the U.S. dollar.

However, some analysts are not ready to give up on gold just yet. Adam Button, chief currency strategist at Forexlive.com, said he is bullish on the precious metal as inflation continues to push higher.

"This week's price action was concerning, but I see it as a head fake," he said. "The main concerns are the duration of global supply bottlenecks and China's 'common prosperity' push."

Nicholas Frappell, global general manager at ABC Bullion, said that he is also bullish on gold as he sees supportive technical factors.

"The Daily Ichimoku Cloud top has been part of the technical resistance around US$1830, but the cloud top drops to US$1803-04 next week, allowing more scope for gold to trade above that level," he said.

By Neils Christensen

For Kitco News

Kinesis Money the cheapest place to buy/sell Gold and Silver with Free secure storage

David