Gold remains above key and critical short-term support but it is the release of Friday’s jobs report that will shape the future direction of gold

Gold pricing has remained fairly stable and continues to trade above $1800 per ounce. The clear break in gold occurred on Friday after Federal Reserve Chairman Jerome Powell spoke at the virtual Economic Symposium. Last Friday’s dynamic surge in gold took the precious yellow metal from its opening price of $1795 top close at approximately $1820. This single-day move took gold pricing above its 100 and 200-day moving averages. During the same period, gold’s 100-day moving average crossed above the longer-term 200-day moving average.

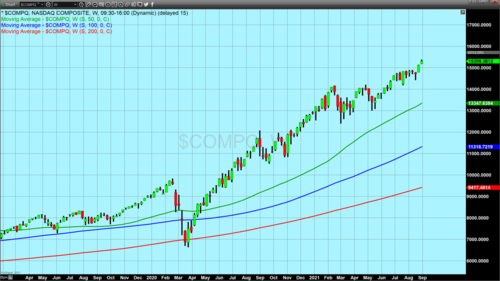

Gold continues to hold its ground considering the strong gains in U.S. equities with the NASDAQ composite, closing at a new record high today. The NASDAQ composite gained 50 points which is an increase of 0.33% and closed at 15,309.3812. The S&P 500 closed at a record high on Monday and is currently trading a few points below Monday's record close.

Dollar weakness has certainly aided in gold’s stable performance. Now for the fourth consecutive day, the dollar has closed lower when compared to the previous day. Today the U.S. dollar index lost 12 points and is currently fixed at 92.515.

As of 5:55 PM EDT gold futures basis, the most active December 2021 Comex contract is fixed at $1816.30 after factoring in today’s fractional decline of $1.80. However it was silver that had a strong advance just shy of 8/10 of a percent, and after you factor in today’s $0.19 gain the December contract of silver is currently fixed at $24.195.

The next report that market participants along with the Federal Reserve will use to determine whether or not the economic recovery in the United States is slowing is Friday's job report. This will help shape or determine the future course of the Fed’s monetary policy as it will have the most recent data indicating whether or not the economic recovery continues to pick up steam, or whether it is contracting due to the Delta variant of the Covid-19 virus.

Today ADP released its private-sector employment data which came in disappointingly below the economist forecast polled by Dow Jones. Estimates for today’s ADP report were that there would be 600,000 new private-sector jobs in August. However, the report indicated that only 374,000 new jobs were added last month. The question becomes whether or not the ADP’s private-sector report is a precursor to a disappointing Labor Department jobs report which will come out on Friday. Typically ADP jobs report cannot be directly correlated to the US Labor Department’s report.

According to CNBC, “U.S. companies created far fewer jobs than expected in August as the Covid resurgence coincided with cutbacks in hiring, according to a report Wednesday from payroll services firm ADP. Private payrolls rose just 374,000 for the month, well below the Dow Jones estimate of 600,000 though above July’s 326,000, which was revised downward slightly from initial 330,000 reading.”

If the Labor Department report comes in under current economic predictions it could have very bullish undertones for gold, and bearish undertones for the dollar. This is because the Federal Reserve’s mandate of maximum employment is the main criteria that the Federal Reserve is currently looking at to guide their future actions in regards to the onset of tapering as well as when they will raise interest rates.

By Gary Wagner

Contributing to kitco.com

Kinesis Money the cheapest place to buy/sell Gold and Silver with Free secure storage

David