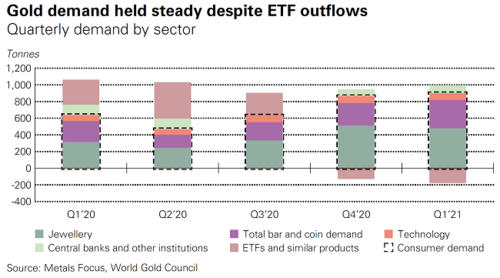

The gold market went back to basics in the first quarter of 2021 as demand for jewelry and physical bars and coins supported a sharp drop in investment demand, according to the latest research from the World Gold Council (WGC).

In its quarterly Global Demand Trends report, the WGC said that physical demand for the precious metal totaled 815.7 tonnes, virtually unchanged compared to the fourth quarter of 2020. However demand was down 23% compared to the fourth quarter of last year.

In an interview with Kitco News, Juan Carlos Artigas, head of research at the World Gold Council, said that shifting demand in the gold market continues to demonstrate the precious duality as an important strategic asset.

“Investment demand can have a significant influence on price, but also you shouldn't completely, disregard what is happening in other parts of the market because that can create support for the price. That is what we are seeing right now in practice,” he said.

Meanwhile, the average gold prices in the first three months of 2021 was 13% higher compared to the first quarter of last year; however, it was down 4% compared to the previous quarter.

Artigas, said that the research shows global gold investment is shifting away from tactical positioning as investment flows out of gold-backed exchange traded funds. At the same time consumers are developing more strategic purchases, taking advantage of lower prices to buy the physical metal in forms of jewelry and bars and coins.

“The support from renewed consumer demand has provided important support for gold, otherwise the price may have fallen further. Yes we have seen outflows in investment demand but we also see positive growth in demand in other areas,” Artigas said.

Looking at investment demand for physical bullion, the WGC said that consumers bought a total of 339.5 tonnes in the first three months of the year, up 36% compared to the first quarter of 2020. The report said this was the highest level of coin and bar demand since the fourth quarter of 2016.

“Bargain-hunting in key markets, notably China, was a major driver of growth in this sector of demand as the gold price fell back from the 2020 peak,” the analysts said in the report. “Fear over rising inflationary pressures was an added driver, as economies around the world responded to the massive fiscal and monetary stimulus introduced to combat the worst impacts of the pandemic.”

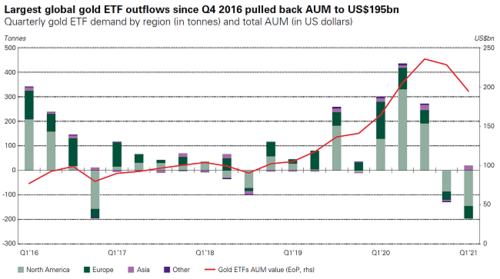

Physical bar and coin demand help to offset significant declines in investment demand. The report said that investment into gold-backed ETF saw outflows of 177.9 tonnes, down dramatically compared to 299.1 tonnes of inflows seen in the first quarter of 2020.

“Outflows quickly mounted through the quarter as inflationary expectations – and, by extension, expectations of higher interest rates – were unleashed. Outflows of this magnitude were last witnessed in Q4 2016, a time when there was a similar re-appraisal of the expected course of US growth and interest rates,” the analysts said.

Although gold investment demand and in turn prices struggled in the first quarter of 2021, Artigas said that the market can still bounce back fairly quickly. He added that rising interest rates at the start of the year had a significant impact on the gold market, but those headwinds should continue to ease through the rest of the year.

“I think investors will return to gold as the Federal Reserve continues to maintain low interest rates,” Artigas said. “Bond yields can’t increase indefinitely. At some point if yields rise too much we would expect the Fed to step in to keep interest rates anchored.”

Artigas added that even if bond yields continue to move higher, rising inflation pressures will mean that real interest rates will remain at historical low level.

The WGC also reported a recovery in gold jewelry demand. According to the data consumers bought 477.4 tonnes in the first quarter, up 52% from the first quarter of 2020. However, the WGC said that while jewelry demand has improved it still has a long way to go to get back to pre-pandemic levels.

“Longer-term comparisons show that [jewelry demand] remains relatively subdued, falling short of the quarterly average over the previous five years of 505.9 tonnes. And it remains well below average first quarter levels too,” the analysts said.

The third important pillar of support in the gold market remains central bank demand. The World Gold Council said that

central banks bought a net total of 95 tonnes of gold in Q1, down 23% compared to the first quarter of 2020.

Although central bank demand saw a slow start to the year, Artigas said that they still expect central banks to be net gold buyers.

“Sizeable purchases and sales from a small group of emerging market banks continued to drive overall central bank demand,” the analysts said in the report.

One interesting feature the WGC highlighted in central bank demand in the first quarter is that the Bank of Japan increased its gold reserves by 80 tonnes as a result of a government transfer between departments.

“Japan’s foreign reserves are held between the central bank and the Ministry of Finance, and this gold purchase has been transferred to the latter’s foreign reserves account. Because this was an intergovernmental transfer of gold, rather than a new purchase, it has not been included in our reported central bank net demand number for Q1,” the analysts said.

Artigas added that if the Bank of Japan didn’t think the gold would be useful the government wouldn’t have made the transfer.

“We can see that central banks think gold has a purpose as a reserve asset and can be a useful tool,” he said.

Looking at the gold supply, the WGC said that the global supply of gold totaled 1,092 tonnes, up 4% compared to the first quarter of 2020. However, total mine supply actually increased 4% to 851 tonnes as producers continued to work through last year’s COVID-19 induced disruptions.

“The overall fall in supply in the first quarter illustrates the importance of recycling and producer hedging to the gold market,” the analysts said.

By Neils Christensen

For Kitco

Kinesis Money the cheapest place to buy/sell Gold and Silver with Free secure storage

David