Déjà Vu – it's happening again

Okay, so it is not déjà vu. In fact, it’s only slightly reminiscent of the last presidential election held in 2016 in terms of how gold prices changed immediately following the release of the election results. In both cases the immediate reaction and move in gold was the polar opposite of what was expected. In 2016 analysts believed that if Donald Trump got elected gold would reach stratospheric heights due to the uncertainty of the first president to be elected that was not a politician.

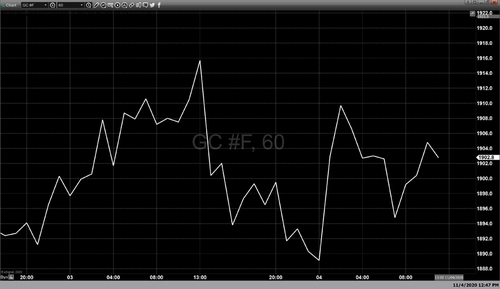

The common thread that the last two presidential elections had was a highly exaggerated knee jerk reaction. This caused swift moves taking gold prices higher for the first hour and then lower. Initially when the election results became clear in 2016 and the candidate which was presumed even before the vote to be the first woman president lost the election.

To be fair, the analysts in fact did get it right as immediately after selling off after the election results were made public, gold over the next four years gained roughly 50% in value. Furthermore, the dramatic rise in gold during the Trump administration had a lot to do with the pandemic that hit the United States and the beginning of 2020 causing the Treasury Department to allocate $3 trillion to fund the “cares act “providing the needed fiscal stimulus to help revitalize the U.S. economy.

A Trump victory inherently contained an uncertainty factor. It was believed that this uncertainty would be the underlying cause that would take gold prices sharply higher. And in fact, they did for about an hour immediately following the election taking gold $50 higher for an hour. However, within eight hours gold prices did 180° reversal and closed $50 lower, the exact opposite of the anticipated reaction to a Donald Trump presidency.

The 2020 presidential election had a similar knee-jerk reaction as it became clear that it would not be a landslide victory for the Democratic candidate but rather a close call with Joe Biden winning the election to become the 46th president of the United States.

Like in 2016 it was anticipated that should the election unfold with a democratic winner gold would gain tremendous ground due to the fear of a unprecedented amount of expenditures needed to fund the fiscal stimulus bill. Market sentiment quickly pivoted once it was clear that the Senate would maintain its Republican majority and thereby contain the prospect of another large fiscal aid package that would further swell our record budget deficit for 2020.

Brian Lundin said that, “Speculators had bought gold in recent days on the prospects for a blue wave that would have put both the White House and Congress in the control of the Democrats, and therefore grease the skids for more-massive stimulus spending.”

Seeing as this election is likely to be contested by the Trump team, and that the democrats are the senate minority with the majority held by republicans the rise in gold prices is likely to have the same outcome as in 2016.

By Gary Wagner

Contributing to kitco.com

David