Gold/silver – all eyes on the Fed this week

It was a rangebound week for gold futures by remaining well inside the bullish "falling wedge pattern" while at the same time, major equity indices fell 10% off their contract highs led by an overheated tech sector. Remember, when markets go parabolic, volatility rises; therefore, you need to reduce your long positions from a tactical portfolio management strategy while increasing your short positions because we know a correction is just around the corner. Long story short, "do not overstay your welcome."

Reviewing the underlying themes for gold and silver in my notebook, this week, the ECB left its policy on hold while growth projections had increased, and they will monitor the impact of the euro on inflation. I suspect that ECB prefers to wait and see what the Fed will do this coming week. The Fed will most likely state that "the committee expects to maintain a target range until it is confident that inflation will run 2% for some time," while increasing QE buying.

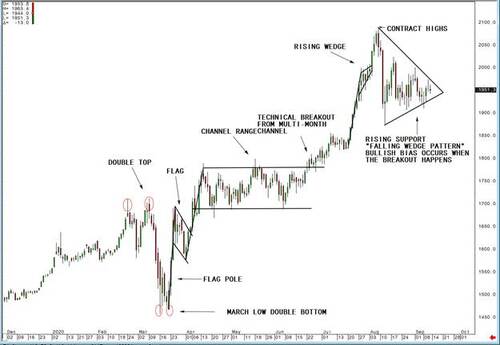

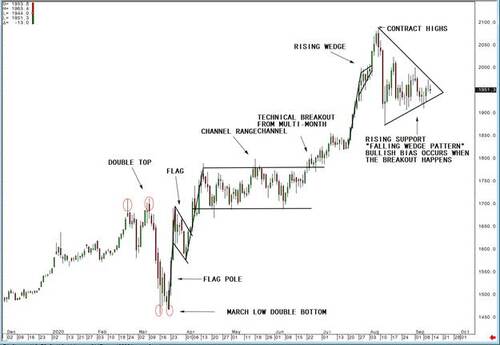

Technical view of the gold market

Gold stalled at major three-star resistance last Thursday at 1973-1976.6 with a high of 1975.2. Despite Thursday's early strength, given the failure and overall consolidation, our momentum indicator continues to hold within previous resistance at 1955.5-1958, our Pivot, and a level in which gold spent quality time overnight. A close outside of 1973-1976.6 and 1928-1932 will encourage direction buying or selling.

I went back through 20 years of my trading strategies to create a Free New "5-Step Technical Analysis Guide to Gold," which you should print out. The guide will provide you with all the Technical analysis steps to create an actionable plan used as a foundation for entering and exiting the market. You can request yours here: 5-Step Technical Analysis Guide to Gold.

Our strategy on gold

If you did not get our recommendation before 1910 hit, you might want to adjust your initial entry to 1930. Otherwise, if you have been working with us and you were and are looking to position in gold for the long run; we suggested that our clients consider using FOUR Micro 10 oz December Gold contracts per $25,000 and buying TWO at 1910 and TWO at 1855, with a stop at 1790. Doing such would ideally risk $3,700. We would look to a gold target of 2275/oz, which would allow for a profit of $15,700. If you would like to be up to date on the developments of our strategies in the futures and commodities markets, please register for a Free two-week trial by clicking on the link here: The Blue Line Express Two-Week Free Trial Sign up.

By Phillip Streible

Contributing to kitco.com

David