After $2,000 gold price, $4,000 is next – Frank Holmes doubles down on call

The fiscal and monetary conditions have never been stronger for gold prices, and while the yellow metal already broke records this week by hitting $2,000 an ounce, Frank Holmes, CEO of U.S. Global Investors, doubled down on his $4,000 an ounce by the end of this bull cycle call.

Price corrections can happen along the way, Holmes said, but gold investors should buy on the dip.

“Every time you have a secular bull market, there are many 10% corrections. So you can easily get a 10% correction in stocks, if you get a 3% correction in bullion,” Holmes told Kitco News. “It’s just recognizing that that ratio of 3-1 is important, and if you have the stomach to weather it.”

On the economy, Holmes expects inflation to rise, but rates to stay low, creating a negative real rate environment.

“The greater the negative real interest rates, the greater the price of gold,” Holmes noted.

Holmes comments come as gold has breached the much anticipated $2,000 an ounce last week. Spot gold last traded at $2029.70 an ounce on Wednesday.

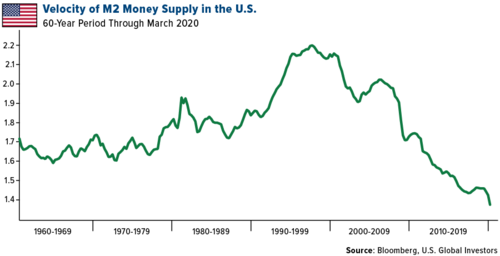

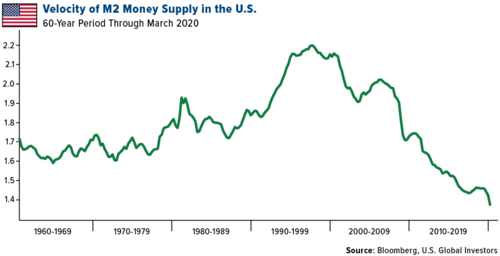

However, money velocity, a measure of the frequency of consumer transactions and is used as a gauge for economic health, has been decreasing, suggesting the people are not spending money.

Holmes argued that money velocity is no longer a valid metric for measuring inflation.

“You just can’t use money velocity now as an indicator of inflation. That’s really an important factor. I think more important is to remember that since 1980 when gold went through $850 and silver $50 and the gold-silver ratio back then was 17-1, you had very high interest rates. It’s very important to put that into context with what we have today,” he said. “The calculations for CPI [the consumer price index] for when gold had hit $850 has changed many times.”

The gold-silver ratio has been dropping as silver has outperformed gold recently, and Holmes said that trend is indicative of more interest from investors in the metals sector.

By David Lin

For Kitco News

David