Does current gold price make sense? McKinsey warns these sectors destroyed permanently

As gold prices breached new all-time highs, confidence in the yellow metal signals to investors a desire to break away from the U.S. dollar, said Ken Hoffman, senior expert at McKinsey.

“The world is trying to get away from the dollar. You’ve seen a number of Chinese sources talk about the ‘de-dollarization’ and as the world tries to look for another currency besides the U.S. dollar, gold makes a lot of sense,” Hoffman told Kitco News.

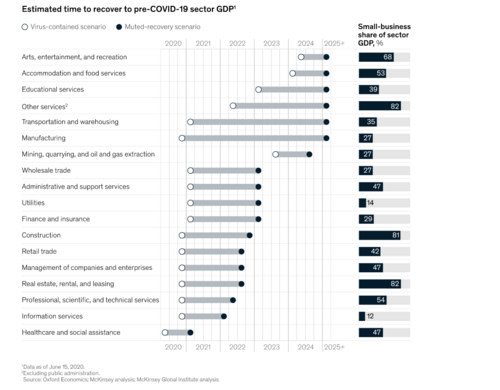

The outlook for the global recovery following the COVID-19 pandemic looks promising for some sectors, but grim for others.

In a recent report published by McKinsey, the healthcare, information services, and technical service sectors will be the fastest to recover, while the arts and entertainment, hospitality, and educational services sectors will take the longest, with a recovery to pre-COVID levels taking place only by 2024-2025.

Mining, quarrying, and oil and gas extraction will also take a few years to recover fully.

Hoffman said that this is due to the oil companies that have been grouped into this category.

“Energy is a big part of that bucket, and energy has been impacted tremendously, particularly in travel…vehicle travel, air travel, ship travel, etc. That is the one area that we think is going to have a long-time recovery. Coal, in particular, may never see a recovery to pre-COVID levels,” he said.

Metals miners are seeing a mixed picture when it comes to a recovery, Hoffman noted.

“From a supply side, it’s been very spotty which industries have been hit by COVID and which have not. In particular, you’re seeing in South America a number of various sort of hits. Most notably is iron ore in Brazil, and copper Chile, has been quite hit as well,” he said.

By David Lin

For Kitco News

David