Precious gift- $1,800 gold, and higher silver ahead

Gold investors on the long side got a precious gift this past week: $1,800 gold!

That means gold has gained 17.9% year-to-date, 29.1% in the last twelve months, and is at 9-year highs last seen in late 2011.

Now that’s momentum. And the drivers for this rise have all the hallmarks of a sustained bull market.

Let’s look at what some of these drivers are…

According to the OECD, global unemployment will reach the highest levels since the Great Depression in the 1930s, nearly a century ago. As well, the World Gold Council reported that investment demand for gold has been extremely robust. Gold ETFs enjoyed the seventh straight month of inflows, up by 104 tons in June, to reach a new all-time high of 3,621 tons. ETF gold buying in just the first half of 2020, 655.6 tons worth an impressive $39.5 billion, has already surpassed the previous record full-year increase in 2009.

ETF gold buying in just the first half of 2020, 655.6 tons worth an impressive $39.5 billion, has already surpassed the previous record full-year increase in 2009.

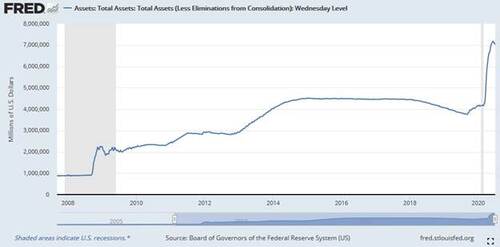

Central bank money-printing has been stratospheric.

Notice how in September 2019, total assets were $3.7 trillion. By June 2020, they had nearly doubled to $7.2 trillion. Let me repeat…in just 9 months, the Federal Reserve almost doubled its balance sheet, adding on an astounding $3.7 trillion.

The Fed buying U.S. Treasurys, and now even corporate bonds and ETFs, helps explain why the stock markets are rebounding so strongly. But these historic levels of money-printing, along with record low interest rates, explain why gold is rallying.

As well, Covid-19 support payments and tax breaks to individuals and businesses around the globe are lighting the flames of support for much higher gold. Last year, nearly 70% of Americans said they had just $1,000 or less in savings.

And while inflation has seemed low for some time, the fact is it has been up by a whopping 44.2% since 2000, and that’s according to the St. Louis Fed.

.jpg)

So gold’s clearly been fulfilling its role as a safe haven. Silver’s, on the other hand, has been lagging behind to some degree.

It’s true that the gold to silver ratio, at 97 currently, is down considerably, but that’s from its recent all-time high above 125. The previous high was just over 100, set back in 1991. The cheaper precious metal is likely to keep climbing, especially relative to gold. And that, historically, has been a good sign for gold as well.

Between 2003 and 2011 there were two major reversals in the gold to silver ratio. Both of those saw silver clock gains of over 300%. I think, given the current economic environment and that we’re coming off the highest gold to silver ratio ever, silver likely has major gains ahead.

From a technical perspective, gold prices have broken out of a sideways consolidation. The range of $1,675 to $1,775 held between April and late June.picAnd interestingly, both the RSI and MACD momentum indicators do not look overbought, while gold is solidly above both its 50-day and 200-day moving averages

.jpg)

We see a similar pattern for gold stocks.

Gold equities, however, are moving closer to overbought according to the RSI. This suggests some caution in the near term.

And looking at the gold stocks to gold ratio, the equities have been in a massive power higher since collapsing in March. A rest in the next days and weeks should not surprise.

.jpg)

A retest for GDX down to the $32 level is possible, and would make for a great buying opportunity.

Meanwhile silver has gained an astounding 50% from its March low near $12.

What’s more, we’ve just gotten a golden cross signal with silver’s 50-day crossing above the 200-day moving average. And the RSI and MACD have room to rise.

Silver supply has been down dramatically in recent months, due mostly to Covid-19 mining shutdowns in Mexico and Peru, the world’s No.1 and No.2 largest producers respectively. So with annual silver supply down dramatically in 2020, coupled with record silver ETF demand at 65 million ounces so far this year, silver’s could be in for strong gains in the second half.

For both gold and silver, there are multiple drivers in place. That could mean an abnormal summer which could skip the doldrums this year. But given the incredible strength of both metals since their March lows, my view is to move forward with caution in the near term.

Still, I expect gold will take out its previous all-time high near $1,900 in the second half of this year, with ease. That’s just 5% higher from current levels.

As for silver, which is near a four-year high, I expect it will surpass its July 2016 peak of $20.29 and go well beyond that in the latter half of this year.

2020 is setting up to be a big breakout year for precious metals. Stay tuned…

By Peter Krauth

Contributing to kitco.com

David