QCP Capital crypto market update – June 08, 2020

Friday's incredibly positive US Non-Farm Payrolls number has led to the largest divergence between Gold and S&P 500 prices since the March lows (Orange line & Red line respectively in the chart below) – with Gold lower and Equities higher. The big question for us is which will BTC follow? Or will it get stuck in the cross-current?

Since end-April, BTC (Beige line) has tracked Gold much closer than it has Equities. So assuming this NFP number was not a fluke and this Gold lower/Equities higher move continues, we can expect some downward pressure on BTC price (and could possibly range below the near-term top that was formed last week with immediate support for BTC at 9250 and ETH at 233).

From the standpoint of the growth of BTC as an asset class, we regard this closer correlation to Gold as something positive. We think that BTC filling the role as a safe haven asset would lead to more adoption and development than if BTC were just a high-beta risk play

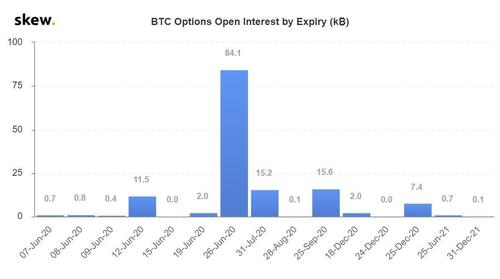

On the options front, the end-June half-year expiry is shaping up to be an exciting one with enormous OI (2x of the huge one in end-May). A large part of this is in calls, reflected in the overwhelming Call OI on CME.

By QCP Capital

David