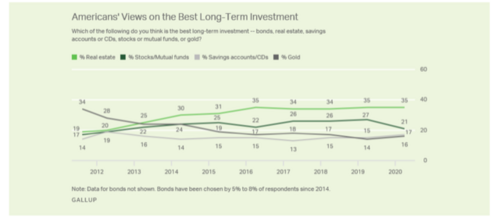

“Americans have become less likely to view stocks or mutual funds as the best long-term investment after U.S. markets dropped by more than a third as the economic implications of the coronavirus outbreak set in last month,” Gallup survey said.

Despite the drop, stocks or mutual funds remain the second best long-term investment choice.

Gold and savings accounts saw a rise in this year’s survey. Gold was chosen by 16% of Americans and savings accounts by 17%. “Roughly one in six Americans view savings accounts or CDs (17%) and gold (16%) as the best long-term investment,” they survey said.

For gold, this is a 2% rise since last year’s survey, which potentially points to a shift in Americans perspectives.

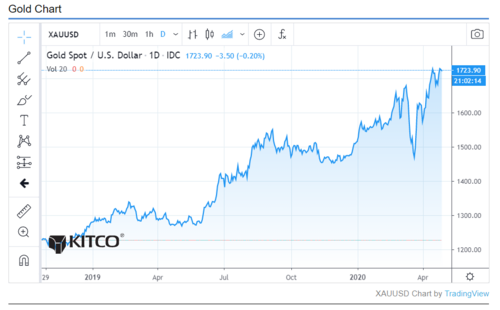

Increased interest in gold is also visible through its price gains over the past year. Spot gold is up nearly 35% since April 2019. At the time of writing, spot gold was trading at $1,725.60, down 0.23% on the day.

“It's possible that the economic fallout from COVID-19 could scramble Americans' preferences, with the stock market in peril and the real estate market's future unclear. In 2011, in the aftermath of the global financial crisis that caused both stock and housing values to plummet, gold was perceived as the supreme investment,” the survey said.

Back in 2011 and 2012 surveys, gold held the number one position as the best long-term investment. At the time, 34% of Americans said gold was the best long-term investment.

Gallup’s 2020 annual Economy and Finance survey was conducted between April 1 and April 14, polling 1,017 U.S. adults.

By Anna Golubova

For Kitco News

David