Dollar strength continues to plague precious metals

Gold continues to fall in the presence of extreme dollar strength which is dictating most of the net change within the precious metals complex. As of 6:15 PM EST the dollar is currently up almost 2%, with the index currently fixed at 103.56.

The last time we saw the U.S. dollar have this kind of strength was in January 2017 when it hit a high precisely where the dollar index is trading currently just above 103.

During this last week alone the dollar index traded from a low of 97.70, and is currently at its highest value this week at 103.56. That is a net change of almost 6% (+5.86%) in a single week. Today’s strong rally in gold accounted for roughly one third of the gains realized this week.

U.S. equities had a mild recovery today but it is not convincing enough to say with any conviction that the selling pressure and carnage is over. This could simply be a. Where equities are consolidating and moving up slightly, or a dead cat bounce. In either case the key is caution and patience as we wait to see how the current coronavirus crisis and pandemic play out.

Still many analysts question why we have seen the stock market lose such a vast amount of market capital, along with gold down dramatically at the same time. The common belief is that market participants are simply liquidating all assets including the safe haven group. However, many believe including myself that at some point if equities continue to drop it will not be just the U.S. dollar gaining strength as a safe place to park your investment capital, and gold will once again return to a safe haven asset.

As reported in MarketWatch analysts at Zaner metals wrote, “We do think that gold has seen consistent cushioning from those unwilling to give up on the idea of gold and silver ‘eventually’ getting safe haven buying. However, for the time being, the primary safe haven instrument (at times the only safe haven instrument) has been the dollar and, therefore, we are highly suspicious of further gains in precious metals particularly and silver.”

Although many analysts expect the U.S. equities to remain under pressure over the next months, which should result in more dollar strength and gold prices remaining week.

It is also hard to explain why with all of the proposed extra stimulus from the government and central banks and emergency rate cuts that the dollar continues to be the favored place to put investment capital as a safe haven.

While we acknowledge that the typical reaction to recent Fed decision to infuse capital and liquidity into the markets, and cut rates to near zero in two emergency moves that gold should have reacted in a bullish manner. The facts remain investment dollars are on the move from equities into bonds, the U.S. dollar and the Yen.

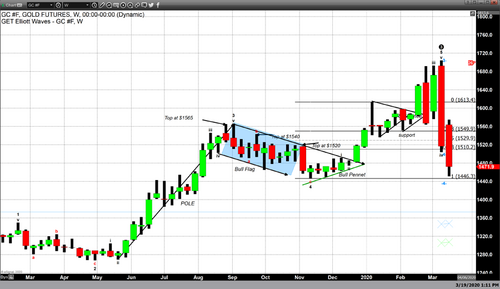

On a technical basis we see major support for gold at $1440 to $1446. This is based on a previous support level in gold that occurred between November and December of last year. This was also the price point that we saw gold spring up to higher prices as it challenged $1700 per ounce for the first time in seven years.

The gold – silver ratio hit an all-time record high yesterday just above 124. Today it backed off a little bit moving down to 121.96. Since this ratio is in uncharted territory it is difficult to predict whether this price point will act as ultimate resistance or a level of consolidation before moving to yet a new record high.

Wishing you as always good trading,

By Gary Wagner

Contributing to kitco.com

David