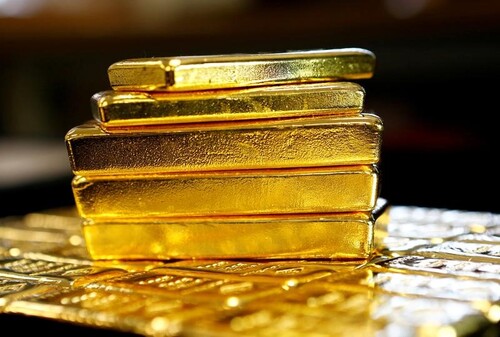

PRECIOUS-Gold inches lower as investors seek clarity on virus severity

* China gears up for Lunar New Year celebrations

* Spot gold may retrace range of $1,551-$1,554/oz- technicals

* SPDR Gold holdings rose 0.2% on Thursday

Jan 24 (Reuters) – Gold edged lower on Friday after the World Health Organisation stopped short of declaring the China virus outbreak a global emergency, though prices were still on track to post a weekly gain.

Spot gold fell 0.1% to $1,561.86 per ounce by 0356 GMT. For the week, prices were on track to gain 0.3%. U.S. gold futures slipped 0.3% to $1,561.50.

“There is not enough information out there in the street yet to be sure that we have a negative situation on our hand and that it would require a move into havens,” Jeffrey Halley, senior market analyst, OANDA, said.

“It is also the eve of the Chinese New Year, so mostly it’s just muted activity ahead of the holidays across Asia, with rising equities, earnings and stable U.S. data weighing on gold.”

Asian shares inched higher following the WHO statement on Thursday that the new coronavirus that emerged in China and spread to several other countries does not yet constitute an international emergency.

However, investors remained concerned about the spread of the virus ahead of the Lunar New Year, a peak period of travel and gold demand in the region.

Data on Thursday showed, the number of Americans filing for unemployment benefits increased less than expected last week, suggesting the labor market continues to tighten even as job growth is slowing.

Further weighing on bullion, the dollar against a basket of currencies, hovered near a one-month high hit in the previous session after the European Central Bank kept interest rates steady on Thursday.

Investors are now focused on the U.S. Federal Reserve’s first meeting of the year scheduled on Jan. 28-29.

“With a low interest rate environment, geopolitical risks and uncertainties such as U.S. President’s impeachment, the conditions are still quite conducive to further upside in gold,” ANZ analyst Daniel Hynes said.

Spot gold may retrace into a range of $1,551 to $1,554 per ounce, said Reuters technical analyst Wang Tao.

Holdings of the world’s largest gold-backed exchange-traded fund, SPDR Gold Trust, rose 0.2% to 900.58 tonnes on Thursday.

Elsewhere, palladium dipped 0.8% to $2,440.82 an ounce, and was on track to register its worst week in five, falling about 1.7%.

Silver was flat at $17.79 and platinum edged lower by 0.3% to $999.37. (Reporting by Sumita Layek in Bengaluru; Editing by Shailesh Kuber)

By Sumita Layek

David