Why Bitcoin Price Could Surge 18% By the End Of the Week

Bitcoin’s precipitous drop to $6,600 seen last month caught many traders aback; nearly no one, not even the top traders and analysts, expected for that price action to play out as it did in real life. Few predicted the subsequent bounce to $7,800, where BTC sits as of the time of writing this, too.

Related Reading: High Likelihood Bitcoin Bottom Came In at $6,400; Here’s Why

Though, one trader has been calling the moves all along, using a lesser-known and slightly unorthodox method of analysis to predict the directionality of the Bitcoin and cryptocurrency market.

The trader, NebraskanGooner. The method, fractal analysis.

Bitcoin Ready to Jump 18%, Fractal Says

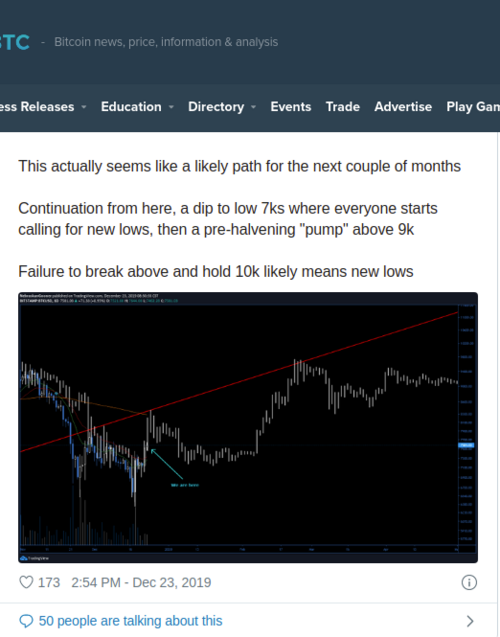

Over the past few months, a popular trader on Twitter, NebraskanGooner, has been touting what is known as a “fractal” via his social media pages. For those who missed the memo, a fractal in financial contexts is when the “historical price pattern or direction of an asset is reflected/seen again on a different time frame and/or for a different asset.”

The fractal that the aforementioned cryptocurrency analyst has mentioned is sourced from Bitcoin’s price action in 2014, specifically the bear market and the subsequent recovery.

Christmas comes early at mBitcasino! 75 BTC in Bonuses and 3 Million Free Spins up for grabs for every player this December, only at mBitcasino! Grab your bonuses now!

As seen below, Bitcoin has been tracking this specific fractal for months now, with it even calling BTC’s most recent decline to $6,400, then the subsequent recovery to $7,700 just this weekend.

.png)

The fractal now suggests that by the end of this week, Bitcoin will be trading at $8,500 — 18% above current prices, before an eventual retracement back to the mid-$7,000s.

Not Only Bullish Signal

Of course, it isn’t only the abovementioned Bitcoin fractal that suggests gains are imminent.

According to Scott “The Wolf of All Streets” Melker, BTC’s performance last week has created a very important signal on the weekly chart: a “massive bullish divergence in oversold territory on Stochastic Relative Strength Index.” For those unaware, the divergence Melker has pointed out is the fact that the Stochastic RSI is trending higher while the price is putting in lower lows.

.png)

Per the trader, this is the fourth time this signal has been seen since the $20,000 top seen in late-2017. The first preceded a bear market rally from $6,400 to $9,900 in mid-2018, the second preceded the 330% jump in the Bitcoin price seen from December 2018 to June 2019, and the third predicted the move from $7,400 and $10,400 that took place just weeks ago.

Considering the historical bullish significance of this signal, there’s a high likelihood that BTC could begin to gain bullish momentum on a medium-term time frame in the coming weeks.

Nick Chong

David