Analyst That Called Bitcoin’s Crash to $6,000s Expects Price to Rebound

In June, when Bitcoin was soaring above $10,000, nearly every trader and their mother expected the cryptocurrency to continue rocketing higher.

Though, one analyst incessantly called for rationality to return to the crypto markets, claiming that this surge above $10,000 was a clear overextension of BTC’s long-term growth curve. He went as far as to say that Bitcoin was poised to return to $6,700.

The analyst, “Dave the Wave” was recently proven correct when late last month, BTC fell from $8,000 to $6,700, validating a call he made over five months earlier.

Although there remain bearish factors in this market, Dave is starting to believe that it’s time for Bitcoin’s uptrend to resume, drawing attention to technical factors to back this optimistic opinion.

Bitcoin Price to Soon Rebound, Prominent Analyst Says

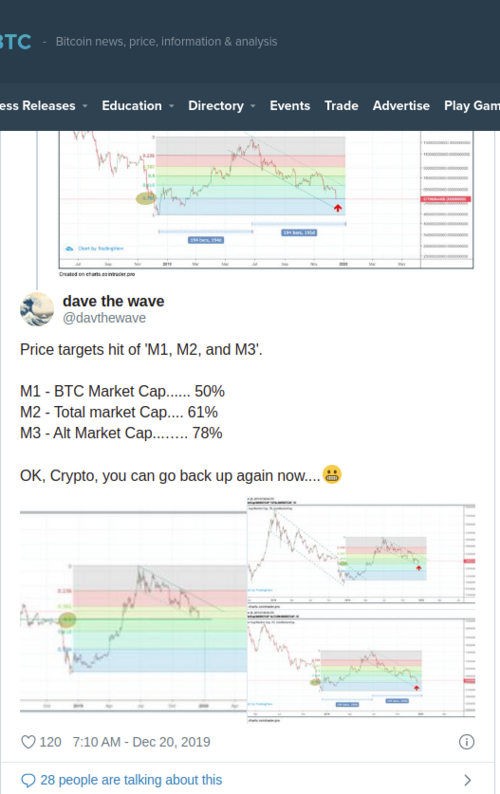

Dave recently noted that his price target’s for the cryptocurrency market’s de-facto “M1, M2, and M3” readings, which in traditional markets are the measure of different forms of “money” in the world’s economy, have recently hit his retracement targets: M1, Bitcoin’s market cap, has seen a 50% retracement; M2, the total market cap, a 61% retracement; and M3, the altcoin market cap, a 78% retracement.

Christmas comes early at mBitcasino! 75 BTC in Bonuses and 3 Million Free Spins up for grabs for every player this December, only at mBitcasino! Grab your bonuses now!

These retracement values are Fibonacci Retracement values, making them notable in the eyes of technical analysts. For Dave, the fact that these measures have reached those retracements implies crypto may soon rebound.

.png)

He followed this up with the post seen below, in which the prominent analyst remarked that he expects for Bitcoin’s one-week Moving Average Convergence Divergence (MACD) indicator to turn upward, which will kick off the next round of growth in the BTC market.

.png)

Related Reading: Bitcoin Price is Poised to Return to $6,500 Lows; Analysts Explain Why

This comes shortly after he asserted that Bitcoin will bottom in the $6,000s, looking to the following confluence of factors to back this analysis:

the three-year moving average—which currently sits in the low-$6,000s—is where BTC historically has found support in early bull markets;

the weekly Gaussian channel indicator is bullish, and the channel’s midpoint sits at $6,600;

the cryptocurrency has bounced off the 0.5 Fibonacci Retracement level of the $3,200 to $13,800 range, implying bottoming price action.

Do Others Agree?

The question remains – do other analysts agree with his lofty sentiment?

Some do, some don’t.

Velvet, a popular cryptocurrency trader, recently argued that “this week[‘s close]” for BTC is “very important,” noting that the key thing Bitcoin will need to do by Sunday’s close is “holding a” key trend line.

For reference, the trend line in question, which always ended up in bear markets when BTC crossed below it, currently sits in the high-$6,000s, which BTC is currently above.

If Bitcoin rides that level, Velvet remarked that Bitcoin “could see $20,000 by March,” referencing the fact that prior to previous halvings, BTC always surged, rallying higher on the expectation that a negative supply shock would hit the market.

Nick Chong

David