Bitcoin price prediction – BTC/USD barely holding at the edge of a cliff – Confluence Detector

Bitcoin futures contracts are likely to be banned from Britain’s retail market.

Bitcoin stares into the abyss after testing the $8,000 weak support area.

Bitcoin continues to lead the market in consolidation. However, a keen observation of the Bitcoin trend, one can clearly tell that the price has a high affinity to declines in the near-term. Its potential to hold above the critical $8,000 is almost non-existent. This follows a correction from an opening price of $8,231 and a bearish leg to $8,063.

In other news, Bitcoin futures contracts are likely to be kicked off the retail market in Britain if the consideration being made by the Financial Conduct Authority (FCA) sees the light of the day. Although matter came to light during a consultation on October 3, a ruling on it will have to wait until 2020.

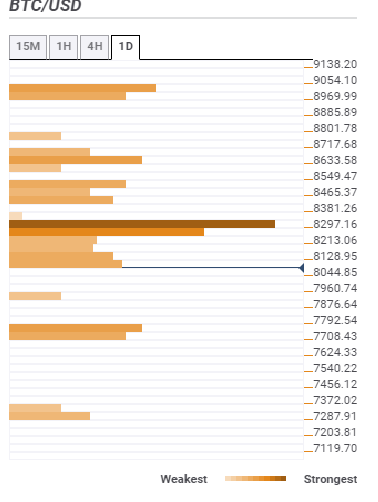

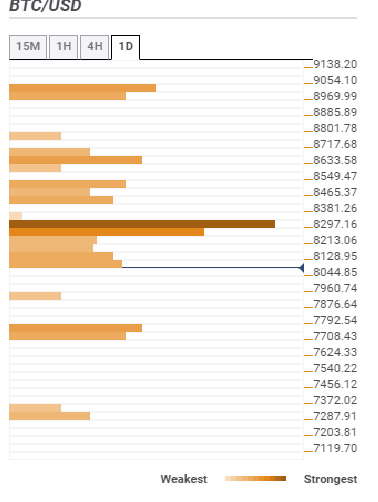

Consequently, as mentioned above Bitcoin is hanging on a thread above $8,000. The confluence detector places the first support at $8,044 (weak support). Glancing lower, the only next viable support area is $7,792 as highlighted using the previous week low, pivot point one daily support three.

On the upside, huge resistance awaits the bulls at $8,297. The indicators converging in this zone are the simple moving average five one-day, SMA 10 one-day, Bollinger Band four-hour middle, Fibonacci 23.6% one-week and the Fibonacci 61.8% one-day.

On the brighter side, if the price manages to clear the resistance at $8,297 the remaining journey to $9,000 will be less bumpy except for a few hurdles at $8,549 and $8,969.

John Isige

FXStreet

David