Bitcoin Pullback Nothing to Worry About, Bull Market Will Follow

Every time Bitcoin dumps a double digit percentage panic floods the crypto community and the doom merchants start rejoicing. This has happened so many times before and every dump has eventually turned into a sustained rally. Nothing is new this time as previous corrections have shown.

Bitcoin Market in 2013 Compared to Now

Observing previous market movements may help us predict the current one. Naturally things are very different in 2019 than they were in 2013 but the chart patterns show similarities. Back then Bitcoin was largely a plaything for geeks with mining rigs made out of gaming PCs in their garages. Today it supports a multi-billion dollar industry but the volatility remains.

One thing that is guaranteed with Bitcoin is price corrections. When it surges things happen fast but when it corrects the price drops even quicker. At the moment BTC has corrected 42 percent from its high this year. A correction of this magnitude had been predicted by many a couple of months ago and it was largely expected by analysts that prices would drop to $8k.

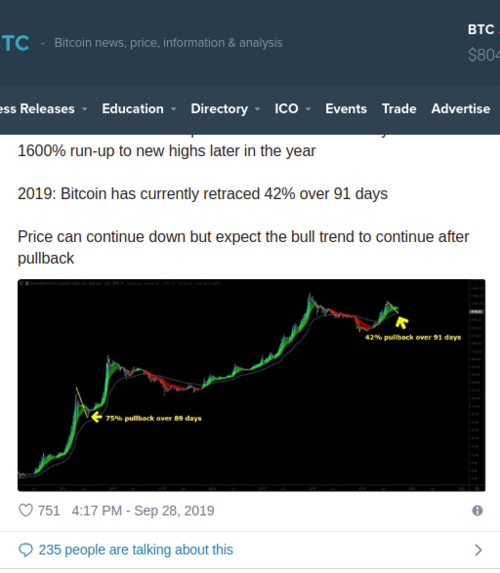

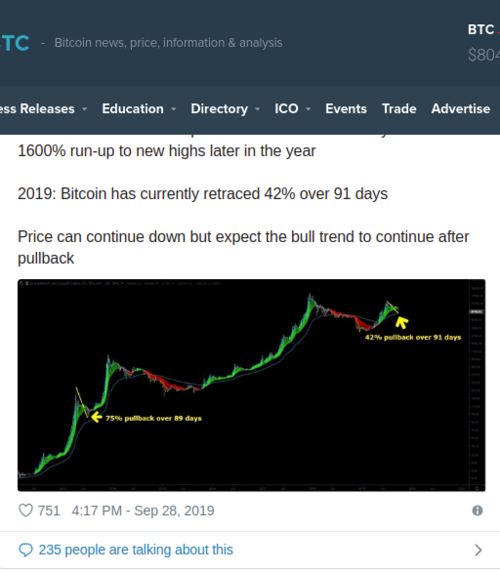

Trader and analyst Josh Rager has been looking at previous corrections and noted that this one is relatively minor in comparison.

“2013: Bitcoin bull market pulled back 75% over 89 days before a 1600% run-up to new highs later in the year.

2019: Bitcoin has currently retraced 42% over 91 days,”

Compared to a pullback of 75% this current correction is ‘no big deal’ he added. Rager also expects price to fall further and eyed the mid-$6,000 region in a more recent tweet.

“IMO, the lowest $BTC will hit: between $6300 to $6600 where there is major interest. Price currently bounced off monthly support & if this area breaks could head to $6600 – based on higher time frames,”

A drop to $6,500 will mean a correction of around 53 percent which is still less than that of 2013. In 2018 BTC corrected a whopping 84 percent from its all-time high to the low just below $3,200 in December.

So far this year Bitcoin is still up 110 percent and the predicted plunge deeper will still keep it 70 percent higher than January’s prices. Corrections provide buying opportunities and traders and investors around the world know this.

It is very difficult to catch the bottoms to buy and the tops to sell so getting somewhere close should be good enough. It seems that traders are aware of this and are holding off buying in at $8k where many expected as further losses now seem very likely.

Those looking at the big picture would have simply been accumulating this year and will continue to do so during this correction. Granted, there has been the biggest weekly dump since early 2018 and many have gone into manic mode – the fear and greed index is a good indicator of this – but this has all happened before, and will all happen again.

Martin Young

David