Bitcoin (BTC) Price Watch – Can It Finally Bounce?

Bitcoin Price Key Highlights

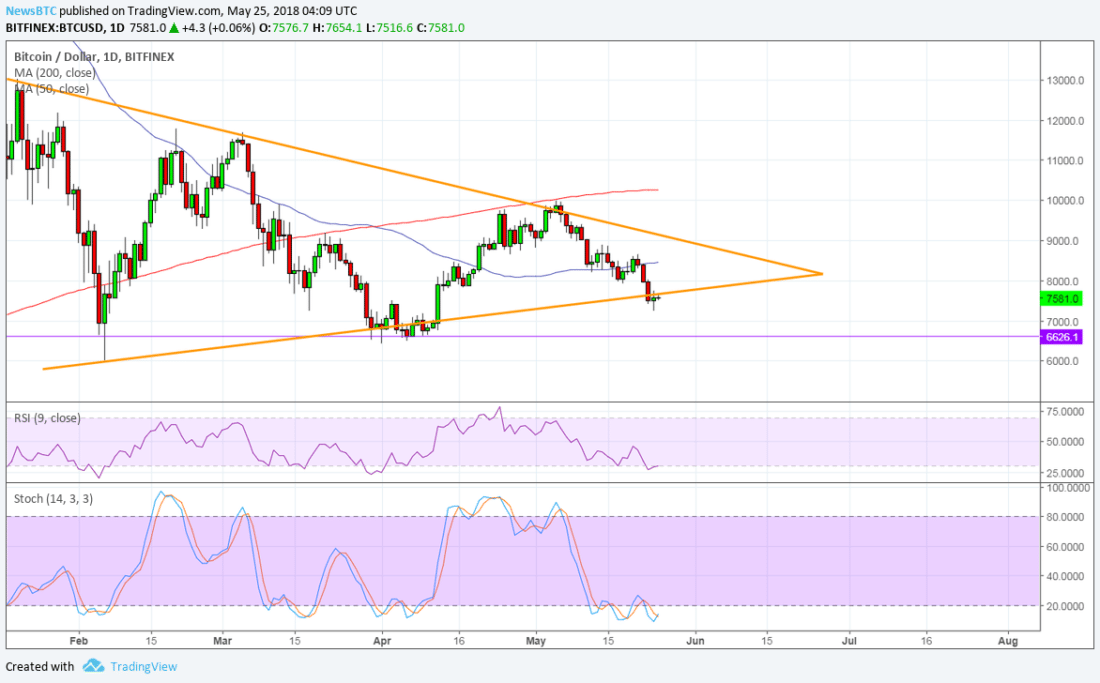

- Bitcoin price is still inside its symmetrical triangle formation and is currently testing support.

- A bounce could take it back up to the resistance around $9,000 while a break lower could lead to a test of the next support at $6,500.

- Technical indicators are showing mixed signals, so the move could mostly depend on market catalysts.

Bitcoin price has sold off to the very bottom of its symmetrical triangle formation, still pending a bounce or a break.

Technical Indicators Signals

The 100 SMA is below the longer-term 200 SMA so the path of least resistance is still to the downside. This suggests that a breakdown is more likely to happen than a bounce.

The gap between the moving averages is also widening to show accelerating bearish momentum. Also, price is below the 100 SMA dynamic inflection point to reflect continued selling pressure.

RSI is heading south to show that sellers have the upper hand, but the oscillator is already dipping into oversold territory to signal exhaustion. Turning higher could draw buyers back in and lead to a bounce back to the resistance. Similarly, stochastic is indicating oversold conditions but has yet to turn higher to signal a return in bullish pressure.

Market Factors

Regulatory fears are being blamed for the recent leg lower in bitcoin price, although this could prove positive for the industry in the longer run. The US Department of Justice is reportedly conducting a criminal probe into price manipulation practices involving cryptocurrencies.

It’s worth noting that the dollar has been on weaker footing following the FOMC minutes release and the recent announcements related to North Korea. Trump has cancelled his meeting with Kim Jong-Un for next month, reviving geopolitical tensions but weighing on the US currency. However, bitcoin price has been unable to take advantage of this as it also seems to have been dragged lower by risk sentiment.

Author SARAH JENN | MAY 25, 2018 | 4:28 AM

Posted by David Ogden Entrepreneur

David