The Federal Reserve announces that they will begin to taper asset purchases this month

As expected, today, after the November FOMC meeting, both the statement and press conference by Jerome Powell acknowledged that they will begin the process of tapering their monthly asset purchases this month. Starting this month, they will reduce their monthly purchases of U.S. debt by $10 billion each month and reduce their monthly purchases of MBS (mortgage-backed securities) by $5 billion monthly. This would mean that they will complete the tapering process in eight months, concluding in June 2022. The Federal Reserve instructed agents at New York Fed to begin executing the reducing bond purchases in mid-November.

But there was a caveat to that statement. During Chairman Powell's press conference, he stated that although the U.S. central bank will begin the reduction of asset purchases this month, he tempered that statement by saying that they were open to adjusting the monthly reductions if called for by market conditions.

Reporters for Reuters, Howard Schneider, and Ann Saphir said that "Policymakers, the Fed said, judge that "similar reductions in the pace of net asset purchases will likely be appropriate each month, but (are) prepared to adjust the pace of purchases if warranted by changes in the economic outlook."

In terms of an interest rate lift-off, it has been widely assumed amongst analysts that an interest rate normalization or lift-off could not begin before the tapering process is complete as it would be detrimental to economic recovery. That being said, the Federal Reserve did not indicate when they would begin interest rate normalization. At the same time, the Federal Reserve made it clear that they intended to leave interest rates where they are until inflation moves back to its 2% target.

Furthermore, the Fed made it clear that they would not consider interest rate hikes until inflation was on track, only moderately exceeding 2%, which Powell stated would take more time than originally anticipated. However, they still have stuck to their belief that the vast majority of inflationary pressures such as supply chain issues and labor shortages will be transitory.

Reuters reported that "Overall, the central bank said it still believed that recent high inflation would abate, but the small change in the language indicated Fed officials see the process taking longer. Inflation by the Fed's preferred measure, the personal consumption expenditures price index, has run at double the target rate since May. Still, officials are reluctant to change their policy outlook until it is clear that the pace of price increases won't ease on its own."

During Chairman Powell's press conference, he said, "As the pandemic subsides, supply-chain bottlenecks will abate and job growth will move back up, and as that happens, inflation will decline from today's elevated levels. Of course, the timing of that is highly uncertain."

One interesting fact contained in today's statement was that "Economic activity and employment have continued to strengthen." This statement conflicts with the most recent GDP numbers for the third quarter of 2021. The government released a report recently showing that the GDP has contracted from 6.7% during the second quarter to 2% in the third quarter.

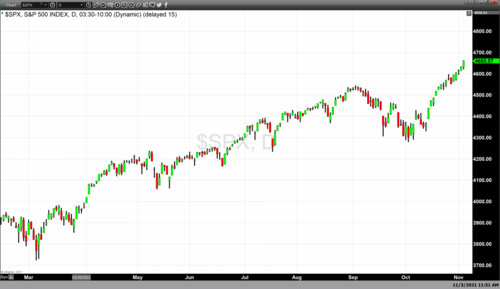

Today's FOMC statements, along with Chairman Powell's press conference had a dramatic impact on the financial markets as a whole. In terms of the U.S. equity markets, they were trading lower before the release of the statement and moved higher as the statement was released and Chairman Powell spoke. All of the U.S. equities closed at record highs with the NASDAQ composite gaining 1.04%, the S&P 500 gaining 0.65%, and the Dow Jones industrial average gaining 0.29%.

Concurrently although gold moved off of its lows seen before the release of the statement and Powell's press conference gold still closed dramatically lower. Gold futures basis, the most active December 2021 contract was trading down by $23 before the release of the statement, and as of 5:35 PM, EDT is currently fixed at $1770.10 after factoring in today's net decline of $19.30, or -1.08%. The dollar also closed lower on the day, giving up 0.23% (0.219 points) and is currently fixed at 93.86.

Unquestionably the Federal Reserve is hedging its bets as it did announce the beginning of tapering but also alluded to their openness to adjust the tapering timeline of asset purchases. Much of their policy is built on the assumption that the current levels of inflation are transitory but put caveats to their tapering process in case they are wrong. The Federal Reserve is less confident that inflationary pressures will subside as quickly as they first perceived. This leaves us to our conclusion to today's press conference.

While the Federal Reserve has not acknowledged that we are in an economic period called stagflation, which occurs when there is persistently high inflation combined with high unemployment and stagnant growth in a country's economy. The economic scenario that the United States is currently experiencing meets all three requirements. If this correctly depicts our current economic conditions it presents a problem.

InflationData.com defined the issues eloquently saying that, "clamping down on interest rates is kind of like stomping on the accelerator with one foot (increasing the money supply) and stomping on the brakes with the other (increasing interest rates). The major problem with stagflation is that the normal methods of increasing interest rates don't help the situation. The only reason it helps in times of high economic activity is because it slows the "velocity of money" or the speed at which it changes hands."

Unfortunately, currently, the Fed is still in denial about the stagflation situation and is maintaining low-interest rates and decreasing the money supply by reducing their asset purchases. Their current strategy is risky; if they are incorrect about inflation being transitory, it could be detrimental to the U.S. economy.

By Gary Wagner

Contributing to kitco.com

Buy, Sell Gold and Silver, with Free Storage and Monthly Yields

David